Passive income while travelling

Did you always dreamed about travelling while still earning some steady passive income? I’ve always been sure that I would like to be getting money even if I don’t work that day. I don’t need much and I have plenty of experience with passive income while traveling. Sleeping at airports, hitchhiking, volunteering for food & accommodation. Even while I write this I have to smile remembering those memories:) Passive income while travelling isn’t only a myth, I hope. I would like to share my still evolving thoughts, trials and errors and try to earn some money while building passive income.

Does 10-15% return on investment sound good enough? For me it was something perfect, exactly what I was looking for. I don’t want to get rich over a night and I know that this is going to be a long process that will take me a lot of my free time. On the other hand it will also allow me to do what I want. To be free as Free mango can be:) However I knew that I didn’t want to put all my money into investing straight away. First I needed to build some “safety net”. Only after I (you) have enough money for at least 3 months of living without actually going to work then you can start thinking about investing.

Investing on Mintos

As I’ve written in How I Started to invest my first investments were in Mintos. It has already been six months during which I didn’t have a single negative thing I would have to say. Taking the first step, starting investing on Mintos, was one of my best decisions so far. It gives me a great control over my money and yet I am getting approximately 12,5%. If you have already registered there let’s have a look at how to start investing.

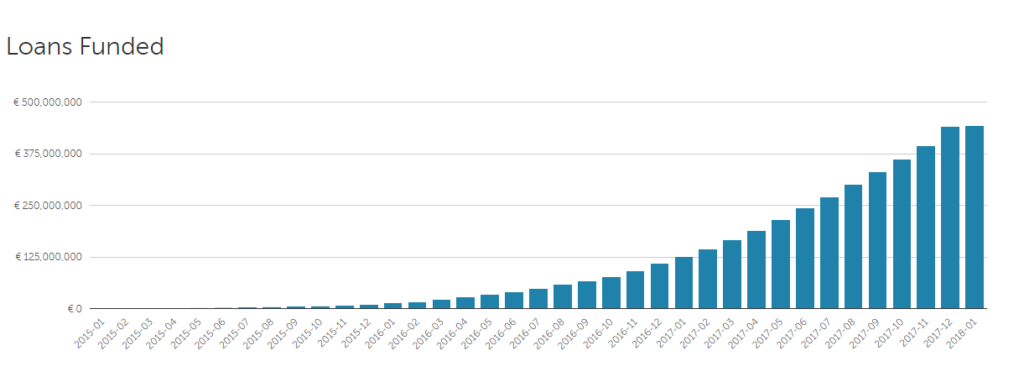

Mintos is a P2P lending platform and during the last 3 years they funded more than 400 000 000€ in loans. I thought that if so many people trust them and are using their services it seems pretty confident. Second I was looking at the type of loans they are providing.

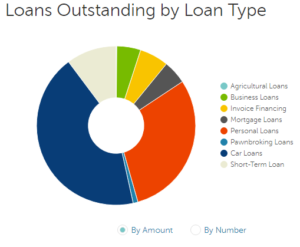

The next chart shows a great variety of Loan Types which I was really happy about because I take investing more like a long-term thing so Short-Term Loans isn’t something I would like to have majority in. Personally speaking I am looking most on Car Loans, Mortgage and Business Loans.

Selecting loans to invest in

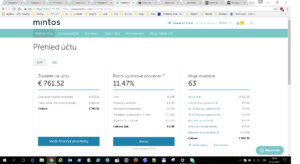

When you login to Mintos, first think you see is the account Overview. This is the place where you can check how is your account doing. Your Net Annual Return is one of the main indicators. It shows the rate of return of the actual investments made in loans. Long story short, this is the percentage you are getting from your investments per year. For me this number is 11,47% which means that from those 760€ I currently have at Mintos I will make roughly 87€ during the year. Maybe not much for you, however don’t forget that this is totally passive income while traveling.

Net Annual Return is based on which loans do you invest. Some are conservative (low-interest rate) and some have the interest pretty high but come with a risk of course. Most of the loans I personally invest is between 8-13% so this overall number fits.

3 tips how to start investing on Mintos

When you have transferred money to Mintos (I prefer to use Transferwise.com when I send money abroad) you can start your portfolio by yourself.

1. Choose the right currency

Even though Mintos offers investments in multiple currencies (at the moment: 8) I would advise to invest in €. Even though there is a small exchange rate risk the majority of loans here are in € so you will get the most options to choose from. There are also a couple of loans issued in Georgian Lari (GEL) for 18% but the high yield is due to the exchange rate risk you are going to be in. Better safe than sorry.

2. Loans with BuyBack Guarantee

This one thing is the reason why I choose Mintos as my main source of investing right now. Almost my whole portfolio is issued in these loans. BuyBack Guarantee is a way of protecting investors from people who don’t payoff their loans. It’s simple. If the loan comes with a BuyBack it means that the loan originator will buy back the loan from investors (you) if it becomes 60 or more days delinquent. Basically, what this means is, if you don’t get paid by the borrower for two months (2 payments) the loan originator will buy you out. You will get the whole rest of principal + the interest you should get for those two payments.

Even if the specific person stops paying you will not loose your money, nor the actual interest. The only risk is that the whole loan originator would go down which is very unreal in my eyes as these companies are always going to be bought by some international trust and will just continue their business under different brand. (Note: I’ve already experienced few loans which were bought back from me and it went completely automatically and smooth).

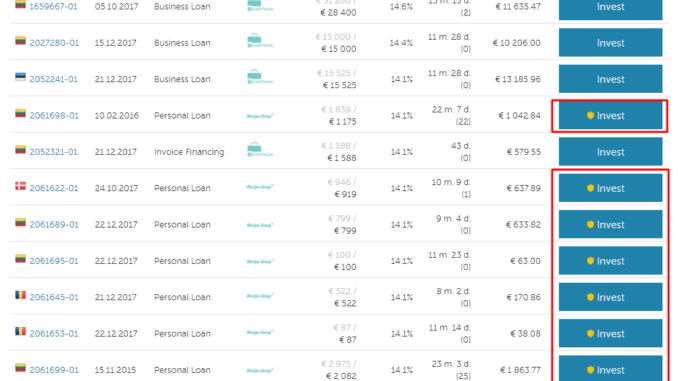

I only have one loan which is not with BuyBack Guarantee and it’s only because it was a mistake and I forgot to check it. These loans are very easy to spot (or even easier if you don’t forget to use the filter …). The “golden shield” next to Invest symbolises that investing in this particular loan is secured.

3. Loan-to-Value

Other thing I like to filter is LTV. It means how significant is the amount (one had to borrow) to the actual price of the thing he wants to buy. For example if someone wants to buy a car which costs 5000€ and wants to take a loan for 3000€ LTV of this loan is 60%. Personally I trust these loans, when there is something real behind it, then just a 270€ loan with no visible purpose and I don’t know in what I invest.

Also there is other side and that if the borrower doesn’t pay the loan originator has still a way how to deal with it and can sell this car and get money back from this. Then they pay you back with the BuyBack Guarantee and you are safe.

Conclusion

So this is a simple way how I try to create a passive income so I have a good feeling that my hard-earned money are working also, even when I am not:) If you have any questions or feedback to this article leave a comment below.

Leave a Reply